Feie Calculator for Beginners

Table of ContentsThe Definitive Guide to Feie CalculatorThe Best Strategy To Use For Feie CalculatorAll about Feie CalculatorThe Basic Principles Of Feie Calculator The Only Guide for Feie Calculator

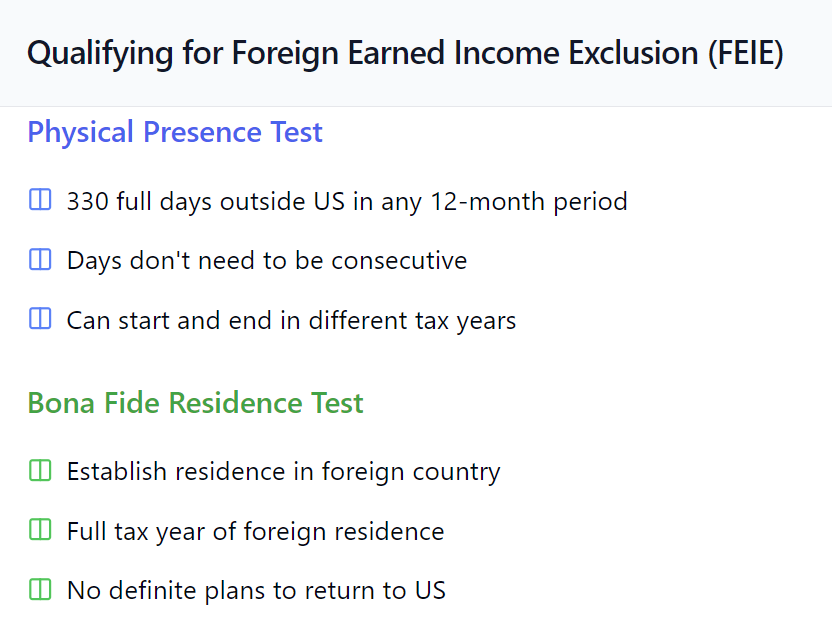

He sold his United state home to establish his intent to live abroad completely and applied for a Mexican residency visa with his partner to help meet the Bona Fide Residency Test. Neil points out that purchasing home abroad can be challenging without very first experiencing the place."We'll absolutely be outdoors of that. Even if we return to the US for physician's visits or business phone calls, I question we'll spend more than 30 days in the US in any kind of given 12-month period." Neil highlights the relevance of strict tracking of U.S. sees (Physical Presence Test for FEIE). "It's something that individuals need to be really attentive regarding," he claims, and suggests deportees to be mindful of common mistakes, such as overstaying in the united state

Fascination About Feie Calculator

tax obligation obligations. "The factor why U.S. taxation on worldwide income is such a large bargain is because many individuals forget they're still based on united state tax obligation even after moving." The united state is among minority countries that tax obligations its citizens despite where they live, indicating that even if an expat has no revenue from united state

tax obligation return. "The Foreign Tax obligation Credit permits individuals operating in high-tax countries like the UK to offset their united state tax obligation obligation by the amount they have actually currently paid in tax obligations abroad," claims Lewis. This ensures that deportees are not strained two times on the exact same income. However, those in low- or no-tax nations, such as the UAE or Singapore, face extra hurdles.

Unknown Facts About Feie Calculator

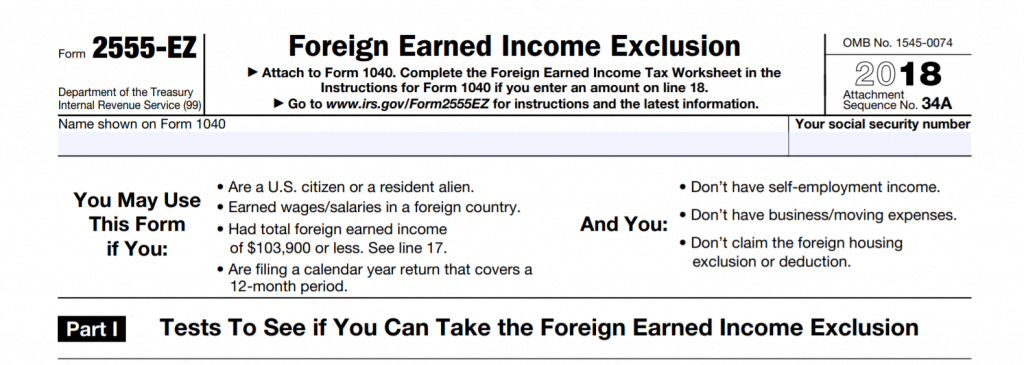

Below are several of one of the most regularly asked inquiries regarding the FEIE and other exclusions The Foreign Earned Income Exclusion (FEIE) permits U.S. taxpayers to exclude approximately $130,000 of foreign-earned earnings from federal income tax obligation, decreasing their united state tax obligation responsibility. To receive FEIE, you should meet either the Physical Visibility Test (330 days abroad) or the Bona Fide House Examination (prove your primary house in an international nation for a whole tax obligation year).

The Physical Presence Test additionally needs U.S (American Expats). taxpayers to have both a foreign revenue and an international tax home.

How Feie Calculator can Save You Time, Stress, and Money.

An earnings tax obligation treaty between the united state and one more nation can help stop double taxes. While the Foreign Earned Earnings Exemption reduces gross income, a treaty may supply added benefits for qualified taxpayers abroad. FBAR (Foreign Savings Account Report) is a called for declare united state people with over $10,000 in foreign monetary accounts.

Qualification for FEIE depends on conference certain residency or physical existence tests. He has over thirty years of experience and now specializes in CFO solutions, equity payment, copyright taxation, marijuana taxes and separation associated tax/financial planning issues. He is an expat based in Mexico.

The international earned income exemptions, often referred to as the Sec. 911 exemptions, omit tax on salaries earned from functioning abroad. The exclusions consist of 2 parts - an income exclusion and a real estate exclusion. The following Frequently asked questions talk about the advantage of the exemptions including when both spouses are deportees in a basic way.

The 5-Minute Rule for Feie Calculator

The tax obligation advantage leaves out the revenue from tax obligation at lower tax obligation rates. Previously, the exemptions "came off the top" decreasing look at this web-site income topic to tax obligation at the leading tax rates.

These exclusions do not spare the wages from US tax however merely provide a tax obligation decrease. Keep in mind that a bachelor working abroad for all of 2025 that made regarding $145,000 without any other income will certainly have taxed earnings decreased to no - successfully the same answer as being "free of tax." The exclusions are computed each day.